The senior healthcare market has provided continuous growth to the Medicare Supplement (MedSupp, also referred to as Medigap) and Medicare Advantage (MA) industry1 over time. From 2009 through 2014, the MA market grew by 46%. In comparison, the MedSupp market grew by 19%. While recent MA enrollment growth has been remarkable, MedSupp growth has also been substantial.

Adding MedSupp to your Medicare product portfolio warrants consideration as a way to realize:

- Enrollment of seniors who otherwise won’t enroll in MA

- Enrollment of seniors in service areas where developing an MA provider network isn’t practical

- A potential hedge against a decrease in the value of MA products for consumers

- Simplicity and flexibility for the health plan

Our article provides further insight into these opportunities and also explores MedSupp challenges and risks.

Enrollment of seniors who otherwise won’t enroll in MA

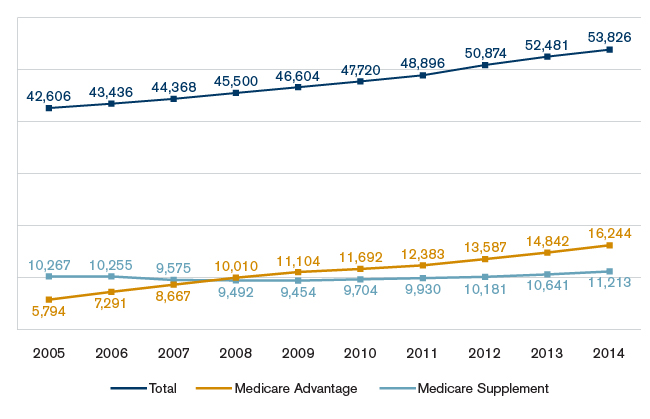

MA and MedSupp are natural competing product lines that are mutually exclusive from the customer perspective as regulation (not to mention practicality) precludes an individual from obtaining coverage from both products simultaneously. This creates somewhat of a split in the senior market segment, a segment that is in the midst of significant growth and will continue to grow over the next several years due to the wave of Baby Boomer entrants. MedSupp could provide an alternative product to MA, which increases overall market share and could boost economies of scale. In Figure 1, we provide a breakdown of the Medicare population over the past several years, along with the respective enrollment in MA and MedSupp.2

Figure 1: Medicare enrollment summary (in thousands)

As Figure 1 shows, prior to 2008 the MedSupp market was larger than the MA market. Note that total Medicare enrollment consists of more than just MedSupp and MA. It also includes enrollees covered by Medicare Fee-for-Service (FFS) alone, employer-sponsored insurance, Medicaid dual eligible, and other public insurance.

While both MA and MedSupp target the senior population, their respective target markets are not identical. Some of the differences and/or unique characteristics are provided below:

- MedSupp enables seniors to see any Medicare provider in the United States whereas MA plans often restrict seniors to a contracted network of providers. A segment of the senior population prefers this simple non-network coverage. This is due to various reasons, such as an anticipated future need to see an MA non-network provider, a history and current relationship with a non-network provider, and/or living in multiple geographic locations, all or some of which may not be included in the MA plan’s service area.

- The MedSupp market is more concentrated in rural areas (29%) than MA (14%).3

- The MedSupp market is more concentrated toward higher incomes than MA.4

- Almost 50% of the MedSupp population has attended college.5

With proper rate management, a MedSupp block can grow to become an important source of membership and future profits. Because of first-year acquisition and commission expenses, profits generally emerge in the later renewal years as the product line matures. However, unlike MA, this requires tracking and monitoring experience over the product lifetime. This is necessary for two purposes. One, the durational nature of claims experience and buildup of credible exposure as the product line matures must be recognized in monitoring results against expectations. Two, historical experience is required for regulatory purposes in order to demonstrate compliance with minimum loss ratio requirements and justification of proposed rate actions.

Enrollment of seniors in service areas where developing an MA provider network isn’t practical

In areas where it is very difficult, at best, to develop or maintain a fiscally appropriate MA provider network that meets the strict Centers for Medicare and Medicaid Services (CMS) regulatory standards, MedSupp offers an alternative because its products generally have no contracted provider networks (the only exception is Medicare Select, which is described briefly later). In the geographic regions where an MA provider network is too difficult to create or maintain, a MedSupp offering might make sense if the number of Medicare eligibles is high enough.

Potential hedge against a decrease in value-add of MA products

MA has existed in its current form since 2006 and MedSupp in its current form since the early 1990s. MA products generally provide more value (benefits in addition to Medicare-covered services for lower premium) than MedSupp for reasons that often vary by organization and/or area of the country. However, over time, the MA payment reforms and changes implemented have reduced the price/value gap between MA and MedSupp products.

As a result of the many implemented changes in the MA market, member cost sharing has increased and/or premiums have increased, resulting in a lower member value-add over time. We define “value-add” as the benefits provided to an MA plan’s beneficiaries above traditional Medicare that are not funded through member premiums. Figure 2 illustrates a $372 decrease in the “value-add” across all regions of the U.S. from 2013 to 2016.

Figure 2: Illustration of annual change in MA value-add from 2013 to 2016

| Time period | Change in benefit value | Change in premium | Change in value-add |

| 2013 to 2014 | -$107 | $19 | -$126 |

| 2014 to 2015 | -118 | 66 | -184 |

| 2015 to 2016 | -24 | 38 | -62 |

| 2013 to 2016 | -$249 | $123 | -$372 |

Source: Milliman Research Report: State of the 2016 Medicare Advantage Industry

This decline in MA “value-add” decreased the relative value gap between MA and MedSupp and we believe the value gap decrease will continue. While in some circumstances MedSupp may never be able to provide as much “value-add” as MA, as the value gap decreases, MedSupp products become a more attractive option for seniors even if they may have to pay a higher premium for MedSupp.

Simplicity/flexibility

MedSupp products are subject to different and less onerous regulatory hurdles than MA. There is no contracting with and rigorous oversight by CMS; MedSupp is regulated at the state level albeit subject to federal law. There are fewer regulatory hurdles for MedSupp. For example, there are no standardized bid/premium submissions, including no hard deadlines regarding submission. There are no detailed compliance requirements for virtually all operations. And there are no CMS reviews or audits of virtually every area of the organization, including the bids. However, there is certainly internal corporate pressure for deadlines regarding experience analysis, proposed rate level determination, and filing for approval in each state in order to make rate changes on an annual basis.

As noted previously, MedSupp products generally have no provider network restrictions. Therefore, resources for network development and contracting are not required. The exception is a version of MedSupp called Medicare Select. Medicare Select plans are connected to provider networks and provide Medicare Supplement benefits only at in-network facilities. The appeal of Medicare Select is a more competitive rate level, which is due to hospital networks waiving all or part of the Part A deductible in exchange for being “in-network.”

MedSupp is exempt from most provisions of the Patient Protection and Affordable Care Act (ACA), such as the health insurance tax (HIT) fee and medical loss ratio (MLR) provisions. As noted previously, however, MedSupp is subject to its own minimum loss ratio requirements.6

Key considerations, challenges, and risks

Entering the MedSupp market is not without challenges and risks. Medicare Supplement plans are subject to benefit standardization requirements, with 10 standardized plan variations, identified by letters of the alphabet, (i.e., Plan A, Plan B, etc.). Differentiation from competitors, other than price, is difficult without name recognition.

MedSupp has remained relatively unscathed from recent ACA-related regulatory requirements. However, recent legislation (H.R.2 – Medicare Access and CHIP Reauthorization Act of 20157) calls for Plan C and Plan F to no longer cover the Part B deductible by calendar year 2020. This would make the benefits of Plan C identical to Plan D and Plan F essentially identical to Plan G. This has potential pricing, experience, and reserving implications.

As with MA, the future solvency of the Medicare Trust Fund and potential solutions will always make MedSupp vulnerable to further legislative action. Recent Medicare reform proposals have called for not only higher cost shifting to beneficiaries (which would presumably increase the benefit level of the MedSupp coverage to cover those costs), but also puts further limits and restrictions on MedSupp coverage, which would conversely lower the benefit level. Ultimately, the relative attractiveness and sustainability of both the MA and MedSupp markets will vary over time based on numerous factors, including the relative value difference between the two products as a result of legislative restrictions and future changes. As a result, offering both MA and MedSupp gives insurers more opportunity in light of the restrictions and changes in the MA market.

Next steps

Given the challenges facing the MA industry, evaluation of the MedSupp industry may be a worthwhile exercise. An evaluation should involve, at a minimum, the following:

1) Reviewing the market landscape in area(s) of choice

2) Understanding the marketing/sales, distribution, and underwriting options

3) Testing the preliminary rate levels for marketability and meeting corporate targets

The information gathered in such an evaluation will inform an insurer whether adding MedSupp to its senior product portfolio makes sense in its particular situation.

1Medicare Advantage plans often include prescription drug coverage (Part D). Those that include Part D are referred to as Medicare Advantage Prescription Drug (MA-PD) plans. Those without Part D are referred to as MA plans. For purposes of this discussion, our use of “MA” will mean both MA and MA-PD plans, and we consider the entire MA and MA-PD industry with an emphasis on MA-PD benefits, which are most common.

2 Note that while the Medicare population is predominantly seniors ages 65 and older, there is a segment of this population that is under age 65 and eligible for Medicare because of disability or end-stage renal disease (ESRD). We have included both population segments in this discussion.

3AHIP (April 2015). Report: Beneficiaries with Medigap Coverage.

4AHIP (2011). Report: Low Income and Rural Beneficiaries with Medigap Coverage.

5AHIP, Low Income and Rural Beneficiaries, ibid.

6MedSupp is subject to an applicable loss ratio requirement (65% Individual and 75% group forms), which applies to future, lifetime, and third and later policy years. This loss ratio is not directly comparable to MLR calculations, however, as there are no expense or tax adjustments.

7Congress.gov (April 16, 2015). H.R.2 – Medicare Access and CHIP Reauthorization Act of 2015. Retrieved January 27, 2016, from https://www.congress.gov/bill/114th-congress/house-bill/2.