Estimated competitive retiree buyout cost, as a percentage of accounting liability, decreased by 60 bps from 99.9% to 99.3% during December

Average pricing buyout costs decreased from 103.2% to 102.8%

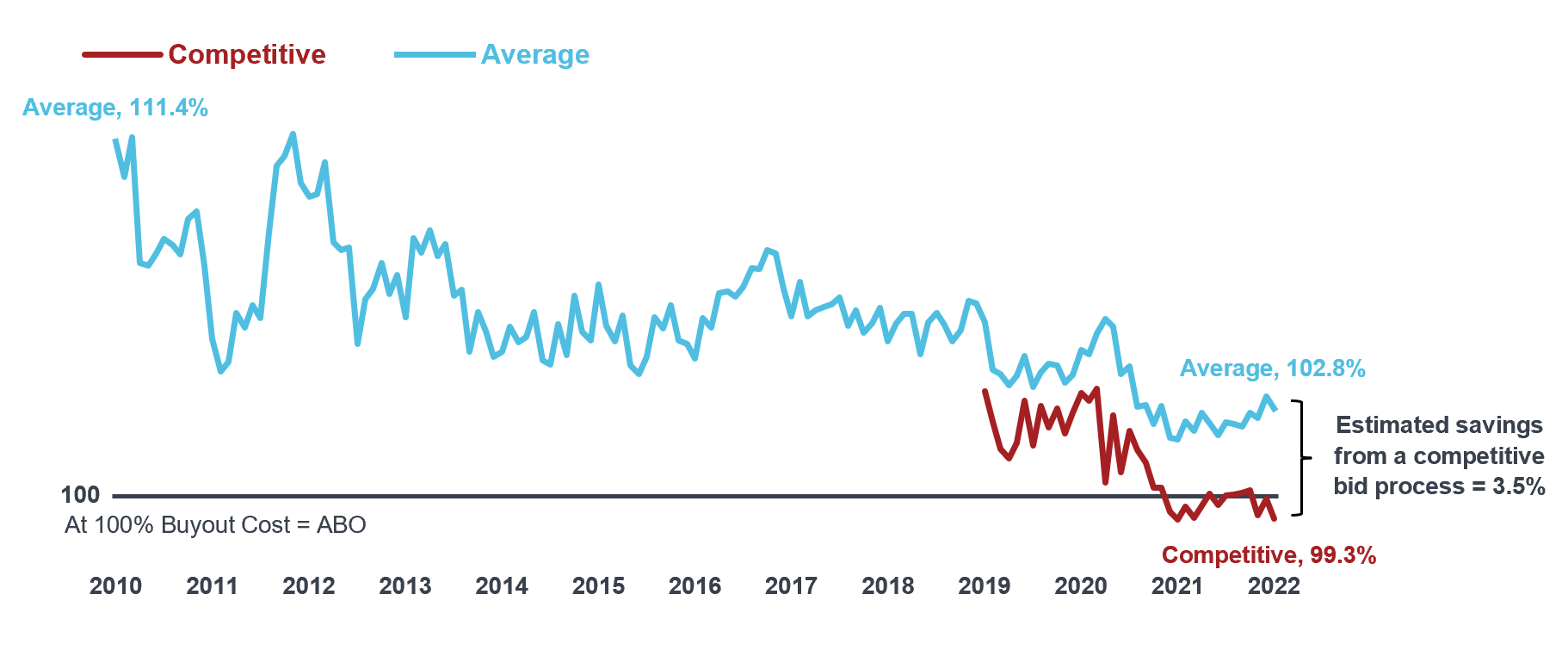

As the Pension Risk Transfer market continues to grow, it has become increasingly important for plan sponsors to monitor the annuity buyout market when considering a plan termination or de-risking strategy. Figure 1 illustrates retiree buyout costs with two different metrics: the red line represents only the most competitive insurers' rates from each month, while the blue line represents a straight average of all insurers' rates in this study.

These metrics demonstrate two important concepts. First, the competitive bidding process is estimated to save plan sponsors on average around 3.5% as of December 31. Second, retirees can be annuitized for an estimated 99.3% of accounting liabilities (accumulated benefit obligation).

During December 2021, average accounting discount rates increased by 6 basis points (bps), while competitive annuity purchase rates increased by 13 basis points (bps). This caused the estimated competitive retiree buyout cost as a percentage of accounting liability to decrease from 99.9% to 99.3%.

When considering these results, please keep the following information in mind:

- Annuity pricing composites are provided by the following insurers: Prudential Insurance Company of America, American United Life Insurance Company (OneAmerica), American General Life Insurance Company (subsidiary of AIG), Minnesota Life Insurance Company (Securian), Pacific Life Insurance Company, Metropolitan Tower Life Insurance Company (MetLife), Massachusetts Mutual Life Insurance Company (MassMutual), and Banner Life Insurance Company (Legal & General America).

- A representative retiree population was used.

- Baseline accounting obligations are estimated using the FTSE Above Median AA Curve. The ratio will be different for plans that use other methods to develop their discount rates.

- Plan sponsors should note that specific characteristics in plan design or participant population could make settling pension obligations with an insurer more or less costly than estimated.

Figure 1: Milliman Pension Buyout Index as of December 31, 2021

About the MPBI

The Milliman Pension Buyout Index (MPBI) uses the FTSE Above Median AA Curve and annuity purchase composite interest rates from eight insurance companies to estimate the cost, as a percentage of accounting liability, of transferring retiree pension obligations to an insurer. To review previous monthly findings, visit milliman.com/en/periodicals/Milliman-Pension-Buyout-Index.

Explore more tags from this article

About the Author(s)

Mary Leong

Contact us

We’re here to help you break through complex challenges and achieve next-level success.